Table of Content

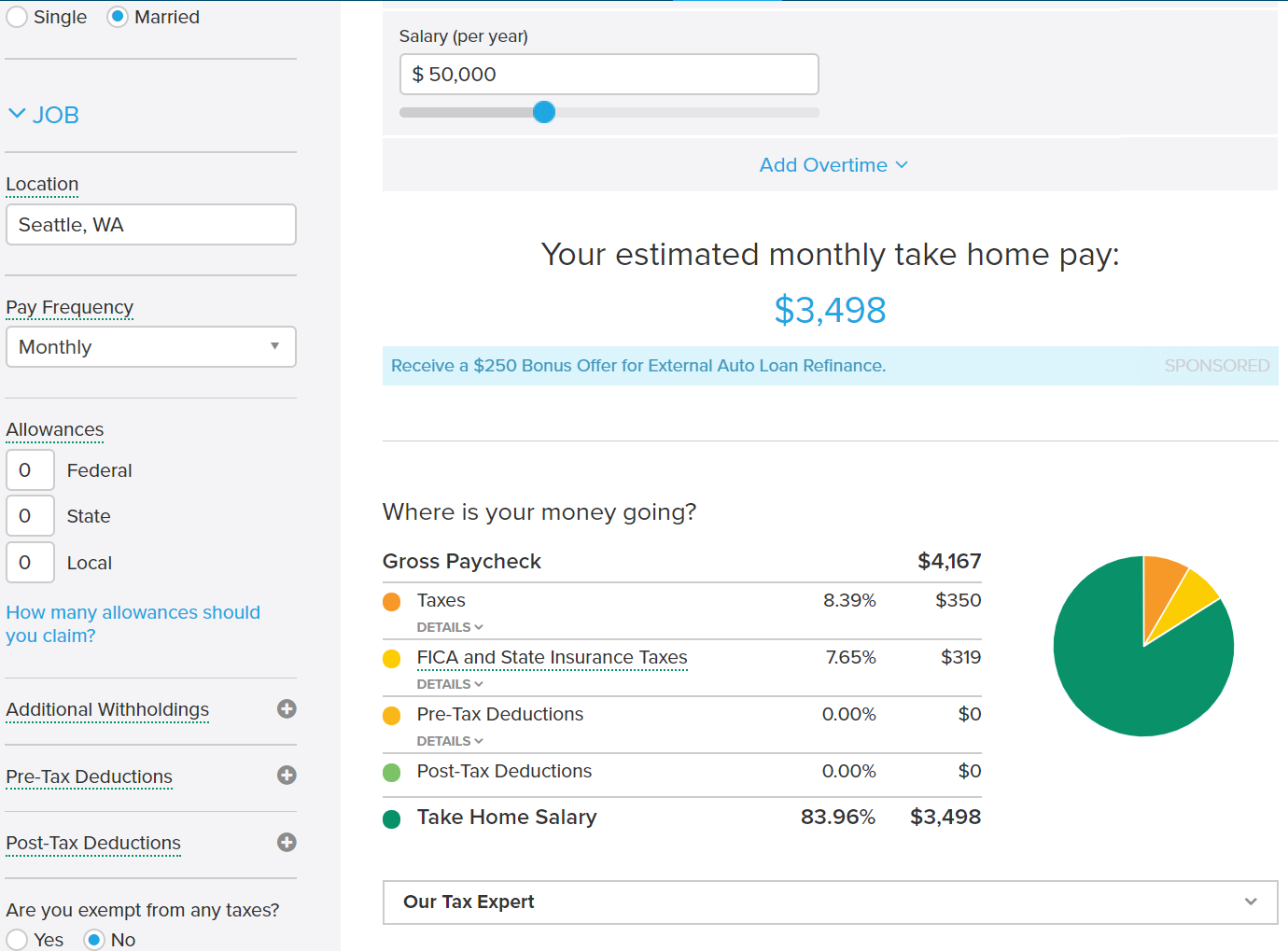

All examples are hypothetical and are intended for illustrative purposes only. When you first started your job, you probably filled out IRS Form W-4. The form asks you for your filing status and then has you calculate how many exemptions you're eligible to take. Based on this information, your employer then withholds what you say is the proper amount of federal income tax from your paycheck. In general, the more withholding allowances you claim on Form W-4, the less money will be withheld for tax and the greater your take-home pay will be.

The money should be invested in mutual funds, and you can sign up with an institution that will accept monthly contributions without a fee. Contributing to a pre-tax retirement plan such as a 401 reduces your taxable income. Because less of your money is being taxed, you can take home more money than if you contributed the same amount to a standard taxable savings account. Though planning for retirement can be intimidating, 401 plans have options that make investing easier for people who might not be familiar with the stock market.

Calculator: How 401(k) Contributions Affect Your Paycheck

He has also written five books on Social Security, IRAs, 401 plans, and Medicare. Pinpointing the exact amount that you need to save to retire comfortably is a difficult task -- and reaching that goal may be even harder. If you're in your 40s, collecting Social Security might seem like the very last of your financial concerns since you're decades away from eligibility age.

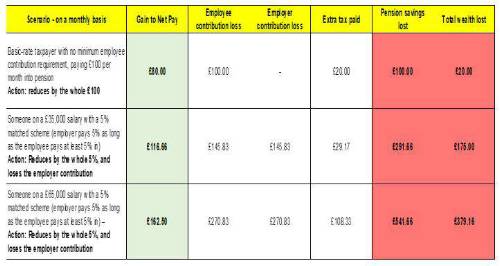

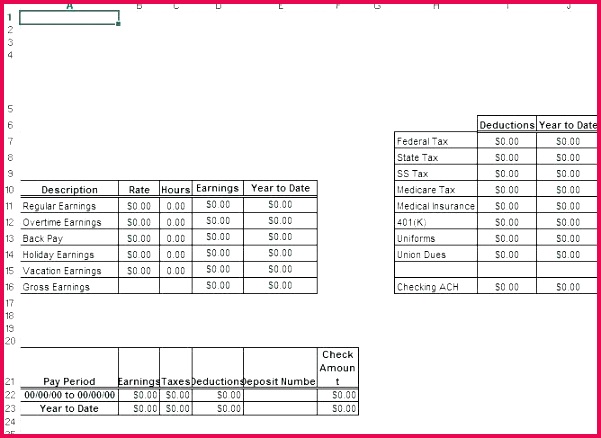

If your employer matches you dollar-for-dollar, your 401 increases by $200 for every $100 you add -- $100 from you and $100 from your employer. If your employer offers a limited match, you should try to up your contribution to that limit. In other words, if the employer match the first 10 percent you contribute, you should work to get your contribution to that level so you can receive the full match from your employer. Making before-tax contributions to a 401 does not reduce the amount taken out of your check for FICA -- Social Security and Medicare taxes. Your part of FICA remains at 7.65 percent -- as of publication -- of your gross pay, or the $2,000, you earned before making your 401 contribution. The 7.65 percent includes a 6.2 percent withholding for Social Security taxes and a 1.45 percent withholding for Medicare taxes.

Federal 401k Calculator

For instance, the contribution limits are the same, including the catch-up contribution. Again, these contributions are made with pre-tax dollars, so your taxable income will be reduced by the amount you contribute. However, there are a few key differences in how safe harbor plans are structured.

And an inflated income can have a ripple effect on a few other things, like your general tax liability. If you’re retired or about to retire, it can also affect how much of your Social Security is taxable and how much you pay for certain Medicare premiums. Roth IRA conversionsallow you to transfer the assets in your traditional IRA into a Roth IRA so that your investments’ growth, and qualified withdrawals, get tax-free treatment in the future.

How a Roth 401(k) Affects Take-Home Pay

Since he has completed five years in the firm, as per the firm’s policy, the company will invest 50% of his annual contribution, subject to a maximum of 8% of the annual salary. Mr. A is contributing 10% of his annual salary and is willing to do so for the next 30 years. He has been earning $30,000 a year, which is paid semi-annually. When he withdraws the amount at the time of retirement, he will be liable for tax on the entire amount since the contributions are made pre-tax and deductions have been taken. The Daily Upside Newsletter Investment news and high-quality insights delivered straight to your inboxGet Started Investing You can do it. In the end, therefore, the tax benefits of your contribution will show up in your take-home pay in each paycheck.

The default setting of 5% was chosen based on the historical performance of several stock indices including the Standard & Poor's 500. The actual rate of return on investments can vary widely over time, especially for long-term investments. This includes the potential loss of principal on your investment.

As a result, your take-home pay will only decline by the difference between $200 and $30, or $170. Each individual decides how much of their paycheck they want to contribute to their 401 plan. You aren't required to put any money into your plan, but you may forfeit matching contributions from your employer if you don't contribute.

Traditional 401 plans are one of the most common retirement plans in the U.S. With the traditional 401, you generally contribute to a plan through your employer via payroll deduction. Your employer might also make matching contributions, which may or may not require you to wait a certain number of years before you are fully vested. For example, imagine you are contributing $500 per month to your 401 every month via payroll deduction.

For advanced capabilities, workforce management adds optimized scheduling, labor forecasting/budgeting, attendance policy, leave case management and more. Now here, an individual’s contribution cannot exceed $19,000, and hence the maximum amount that can be invested, including both, will be $19,000. If you’d like to have us work with you on your financial questions, follow this link for more information on how to get started.

In general, this is the advantage of pre-tax dollars going toward your future. However, there are some additional specifics we will cover for common types of 401 plans. A traditional 401 is a good option because it can reduce the amount you pay in taxes now, which may make it easier to continue investing when money is tight. This means that your taxable income is reduced, so the amount you pay in taxes is less. Your take-home pay won't be affected by the same amount you contribute.

Investing less of your salary over a longer period can actually result in more money than by investing double the amount in half of the time. Start now with any amount you can, and build up to your goal over time. Plug in the amount of money you'd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. We provide payroll, global HCM and outsourcing services in more than 140 countries.

As a result, when you make a 401 contribution, the taxable part of your total pay goes down. This has an impact not just on how much income goes into your paycheck but also on how much gets withheld for federal and state income taxes. In addition to not paying tax on the money you contribute to your 401, you also don’t have to pay tax on investment returns.