Table of Content

Amounts matched by your employer are not included in this limit. Participants age 50 and older are allowed to contribute an additional $6,000 “catch-up” contribution, bringing the total allowable contribution to $25,000. If you make a total of 6% in contributions to your 401k, the company will match that with 3.5% contributed to your account.

It is not intended to provide, and should not be relied upon for, investment, accounting, legal or tax advice. You could lose money by investing in a mutual fund, even if through your employer's plan or an IRA. An investment in a mutual fund is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Current Age

Download this questionnaire which helps to determine your investor profile. Questions about lifestyle, personality, risk tolerance, when you want to retire, and other financial considerations are helpful in charting a plan and making decisions. Your contributions are taxed in the year they are made, so your taxable income is not reduced by the amount of your contribution. And the comparison is against much more than 3.5% – this actually represents more than a 58% return on your contribution for the year (3.5% / 6%). An outside investment would have to gain better than 58% in order to do better than the company match. Pretax contributions are subject to the annual IRS dollar limit.

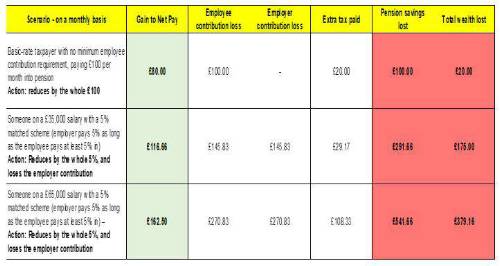

Contributions are typically made pre-tax, which means that they can reduce your taxable income for the year. Contributing to a 401 can generate a large immediate rate of return on your investment. Let's see how investing 10% of a $1,250 biweekly paycheck could affect your assets. These calculations are provided for illustrative purposes only, and should only be used as a guideline. They are not representative of past or future performance and not a replacement for professional financial planning advice. Paychex and its affiliates do not offer investment or tax advise.

Paycheck impact calculator

Neither these calculators nor the providers and affiliates thereof are providing tax or legal advice. You should refer to a professional adviser or accountant regarding any specific requirements or concerns. Contribution Rate Percentage of your salary you're currently contributing to your plan account. If you contribute a portion of your salary on a dollar deferral basis, you can convert your dollar deferral portion to a percentage for purposes of this calculator.

It's also a good idea to maximize your employer's contributions, although you should ensure that you have emergency savings set aside before saving too aggressively for retirement. You should still be saving for retirement if your company doesn't offer a 401 plan, or if you have to wait for a year to begin participating. You can do this by setting up a Roth IRA account through a brokerage firm or a bank.

Federal 401k Calculator

Rebalancing a portfolio is important in maintaining the correct proportions of assets. Over the course of time, some of your assets will do better than others, increasing their percentages within your total investment. It is important to monitor your assets and correct the imbalances to stay within your target allocations.

If you up your contribution to $300, the part of your pay subject to income taxes drops to $1,700. Someone who qualifies as head of household may be taxed less on their income than if filing as single. This is because the tax brackets are wider meaning you can earn more but be taxed at a lower percentage. This status applies for people who aren’t married, but adhere to special rules.

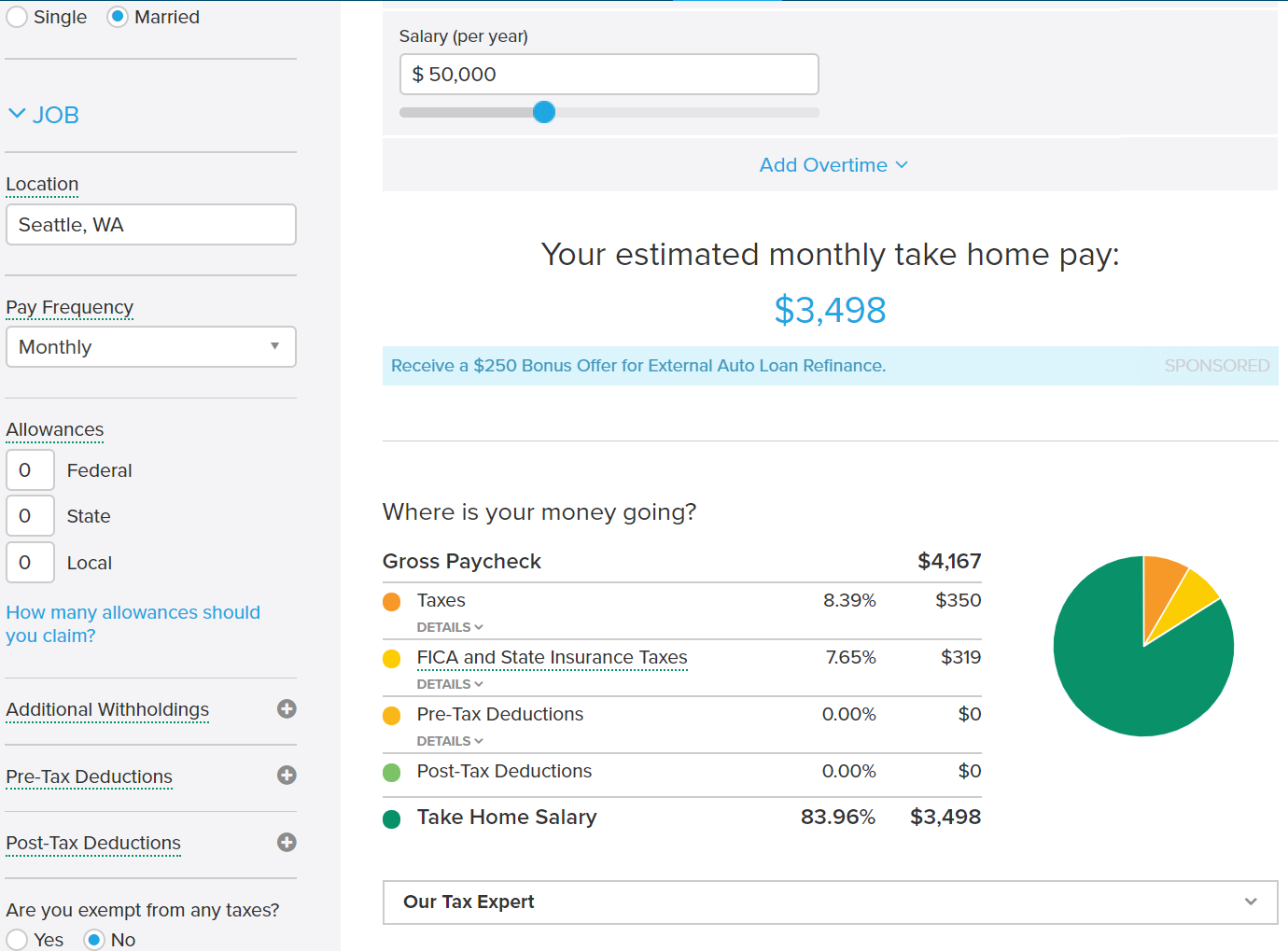

Of course, taxes will be due when you withdraw money from your Plan. For example, if you made $30,000 last year, and put $3,000 in your retirement plan account on a pre-tax basis, your taxable income for the year would have been $27,000. (Note that other pre-tax benefits could lower your taxable income further.) After-tax contributions are those you make from your net pay, that is, your income after taxes.

In general, this is the advantage of pre-tax dollars going toward your future. However, there are some additional specifics we will cover for common types of 401 plans. A traditional 401 is a good option because it can reduce the amount you pay in taxes now, which may make it easier to continue investing when money is tight. This means that your taxable income is reduced, so the amount you pay in taxes is less. Your take-home pay won't be affected by the same amount you contribute.

He has also written five books on Social Security, IRAs, 401 plans, and Medicare. Pinpointing the exact amount that you need to save to retire comfortably is a difficult task -- and reaching that goal may be even harder. If you're in your 40s, collecting Social Security might seem like the very last of your financial concerns since you're decades away from eligibility age.

Think about the long-term benefits of investing in your retirement. How your contributions are withheld from your paycheck depends on the specific type of 401 you have. This move can allow you to rein in your taxable income for 2022 and plan for 2023.

Let's see how to rebalance those assets back to their target allocations. With the GuidedSavings tool by GuidedChoice®, you'll receive a detailed and personal analysis of all of your retirement factors. This analysis will provide a specific recommendation that you can follow, or you may decide to implement a strategy of your own. Enter what you have currently saved, how much you could put in a monthly contribution to a 401, and how much your employer/the business owner may match. Begin with information about you, including your annual salary, the state you reside in, your current age, and the age you aim to retire. Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

There is a lot to consider as you decide how to fund your retirement. To ensure that you get the results you want, it is important to align your full financial situation with your financial goals and to speak with a professional. Some employers allow participants to their traditional 401 plan to convert their plan to a Roth 401 while they are still employed at the company. Although this option is not widely available, it can be beneficial.

Bankrate.com does not include all companies or all available products. Based on the given information, you are required to calculate the contribution amount that will be made by Mr. A and his employer. Step #5 – Determine whether the contributions are made at the start or the end of the period.

In addition, they are similar to safe harbor plans in that matching contributions are immediately fully vested. Another key difference with safe harbor plans is that matching contributions are fully vested immediately. In other words, employees can’t be required to wait a certain number of years before they are fully vested; that happens as soon as money is contributed. There are multiple types of safe harbor plans, such as basic plans and enhanced plans. With basic plans, employers match 100% of contributions up to 3% of employee compensation, and 50% of contributions up to 5% of compensation.

No comments:

Post a Comment